Growth is good. But it also raises the stakes.

When you’re ramping up business inspections, hiring team members, and putting real dollars behind your marketing strategy, you’re not just building momentum – you’re also increasing your exposure to risk.

That’s where insurance comes in.

Think of Errors & Omissions (E&O) and General Liability (GL) insurance as your business’s safety net. They don’t just protect your revenue – they protect your reputation, your clients, and your ability to grow confidently.

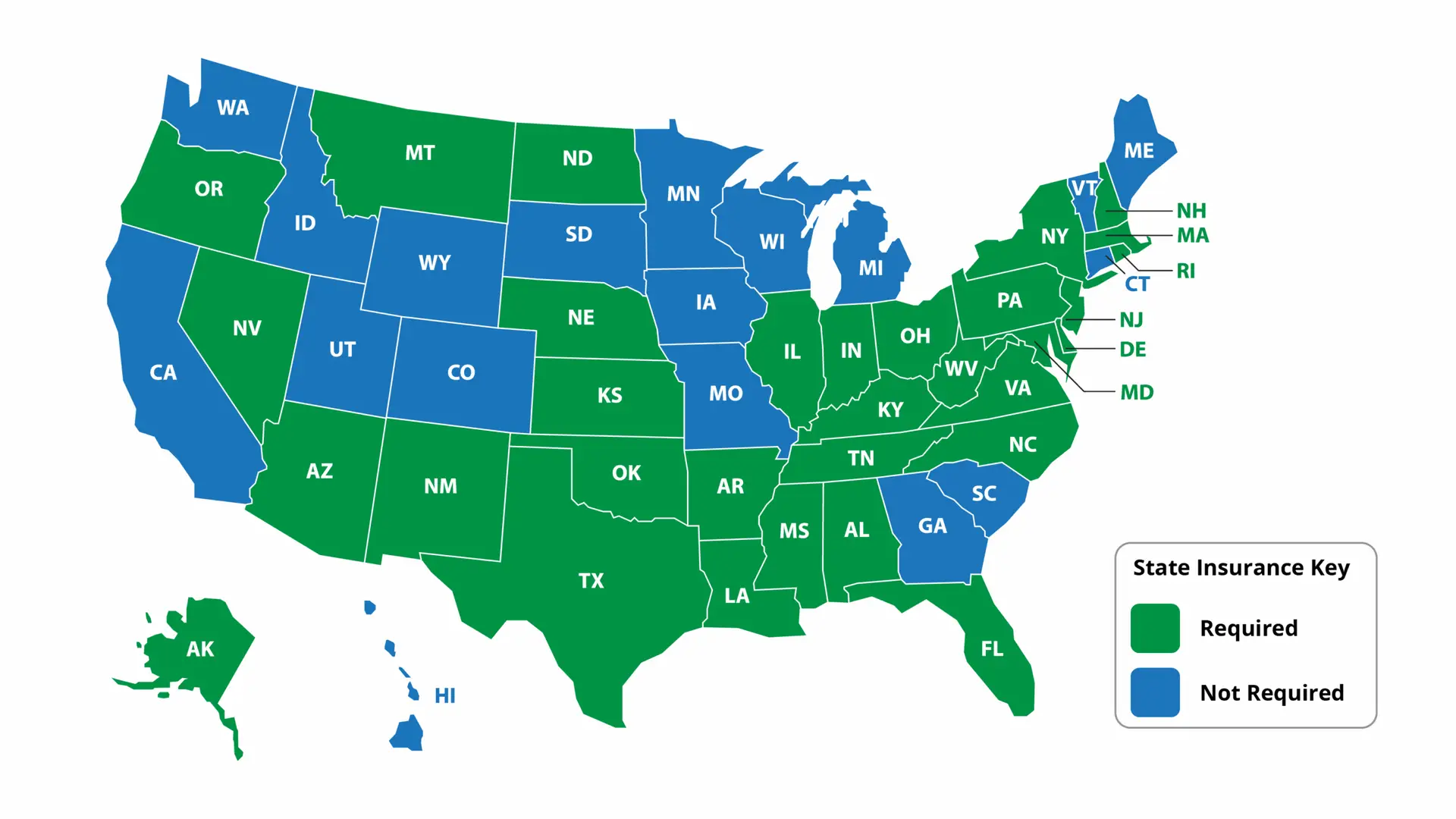

30 states require some form of insurance to operate as a licensed home inspector. And even where it’s not mandatory, many agents and clients won’t work with you unless you’re covered.

Understand the essentials: E&O and General Liability

Errors & Omissions (E&O) covers the professional side of the job – missed defects, reporting errors, or anything that might get flagged as a service issue.

Example: A client claims you overlooked a plumbing issue that led to a flood. E&O can help you cover legal fees and any settlements.

General Liability (GL) protects against physical accidents or property damage during the inspection.

Example: Your ladder scratches hardwood floors, or a client gets injured during a walkthrough. GL can help cover those costs.

Together, these policies form a solid foundation for risk management as your business grows.

More growth – More exposure

As you scale, complexity increases. And with it, so does the chance that something could go sideways.

- More inspections mean more opportunities for a detail to get missed – and more chances for disputes to arise

- Hiring W2s or 1099s? Their actions in the field fall on you, legally and professionally

- A growing reputation makes you more visible – and more vulnerable if something goes wrong

Even one lawsuit could eat through your savings and set you back months. Strategic insurance choices help protect your progress.

Smart insurance choices for scaling inspection businesses

As your business expands, so should your coverage. Here are four ways to make sure your insurance keeps pace:

- Reevaluate your policy limits: That $100K policy might have worked early on, but more volume means more potential liability

- Team coverage is critical: Make sure your policy includes coverage for your employees or contracted inspectors who work exclusively for your company

- Choose industry-focused providers: Work with insurers who understand the inspection business inside and out

- Tap into risk management tools: Providers like InspectorPro offer education and claims-prevention resources that help you steer clear of issues before they start

Need coverage that’s built for inspectors?

ISN partners with InpectorPro to offer coverage tailored to home inspectors at every stage of business.

You get:

- A simplified application process

- Support from a team that knows inspection claims

- Coverage that scales as you grow

Growing a business is more than inspections – it’s about protecting your investment. E&O and GL aren’t just expenses, they’re essential tools in your business toolkit.

Protect what you’re building. Learn more and get started with ISN Business Insurance with InspectorPro.