Rising real estate values and increasing rents have stretched budgets for homebuyers and renters over the last two years. The median home sales price in the U.S. jumped by nearly $100,000 from the first quarter of 2020 to the first quarter of 2022 amid low interest rates and a stronger-than-expected pandemic economy. Rents were flat for much of 2020 with COVID-related renter protections and rental assistance programs in place but accelerated in 2021 and the first half of 2022. Median rent in the U.S. has increased by more than 15% over the past year and recently passed $2,000 per month for the first time.

Since the beginning of 2022, the U.S. Federal Reserve has raised interest rates in efforts to combat inflation throughout the economy. Between rising mortgage rates and the rapid run-up in home values, the residential real estate market has shown recent signs of cooling. But while a leveling out in demand could slow the pace of price increases, these measures cannot solve another fundamental challenge in the U.S. housing market: a major shortage of housing supply.

Researchers at federal mortgage backer Freddie Mac have estimated that the U.S. has a housing supply shortage of 3.8 million units. This shortage has been fueled in large part by a decline in single family home construction, particularly for starter homes, dating back to the 1980s. And with millennials now comprising the largest generational segment of the homebuying market, a lack of affordable entry-level homes has driven competition for housing and kept larger numbers of young adults renting, contributing to price increases for buyers and renters alike.

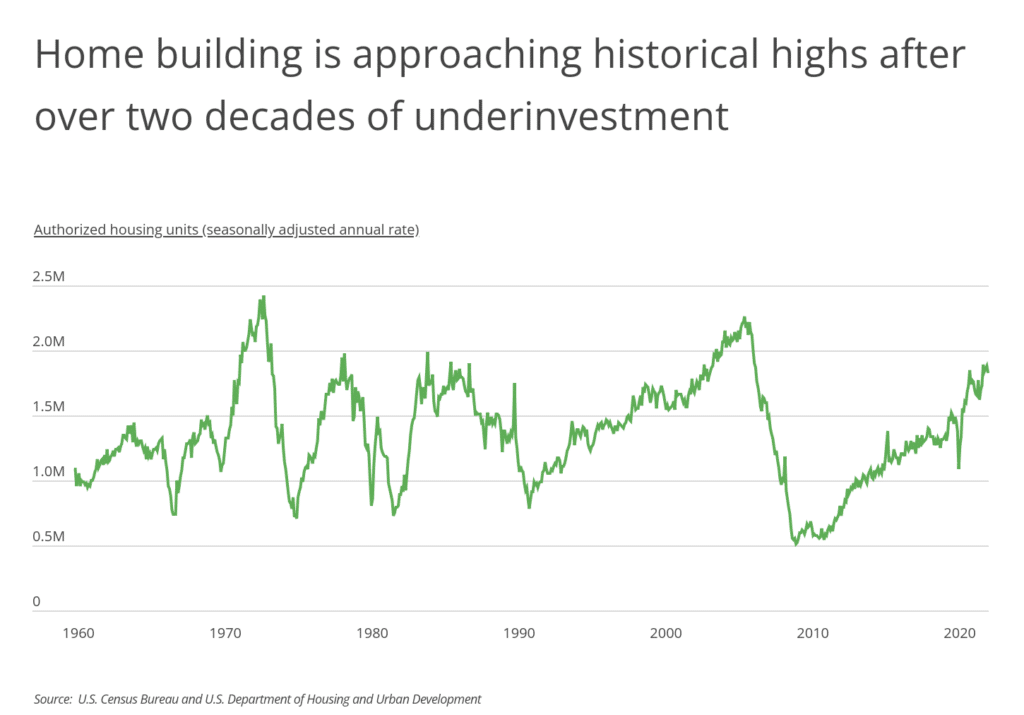

The lack of housing supply has been exacerbated by significant underinvestment in new housing since the last recession. New housing authorizations tend to fall temporarily during economic downturns, but the collapse of the housing market in the mid-2000s and ensuing Great Recession sent annual housing authorizations to historic lows. New housing permits have recovered slowly over the last decade, only recently surpassing historic averages.

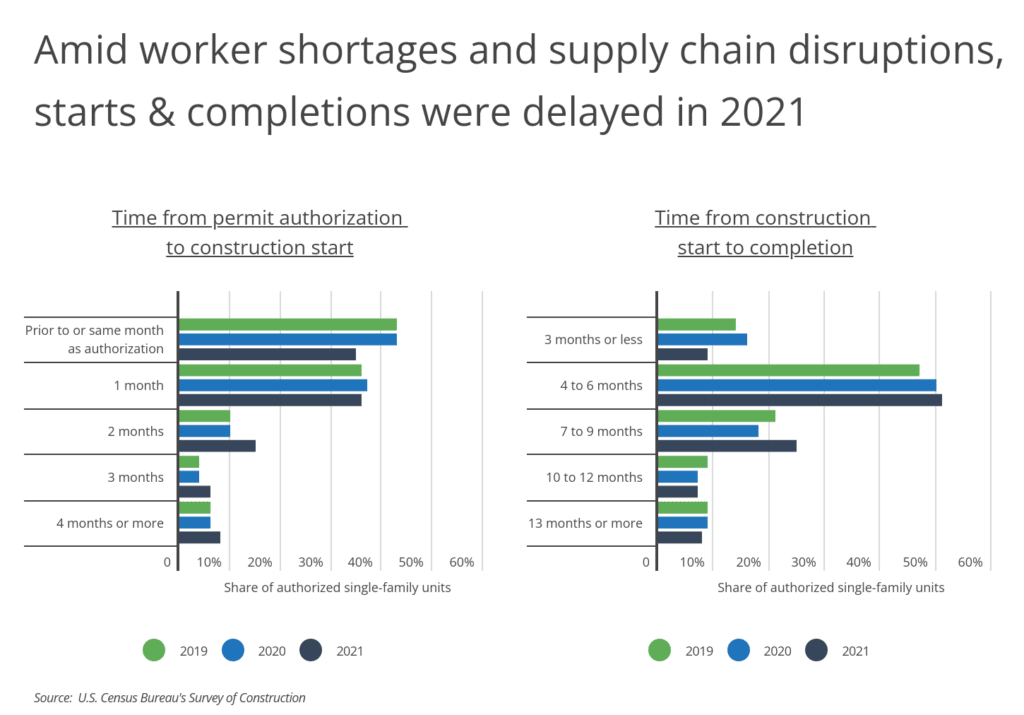

Despite recent demand and a clear need for new housing supply, the construction industry has struggled to keep up during the pandemic. COVID-related disruptions have produced worker shortages and hindered supply chains, making it harder and more expensive to obtain building materials. As a result, more single-family units are seeing monthslong delays in the time it takes to start and complete construction when compared to years past.

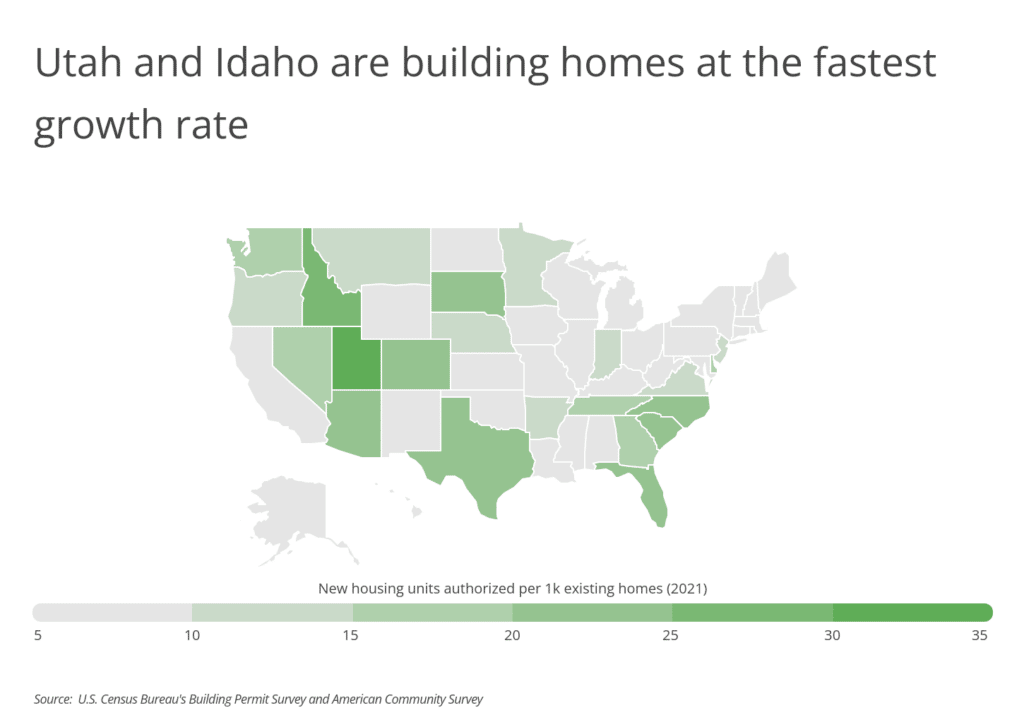

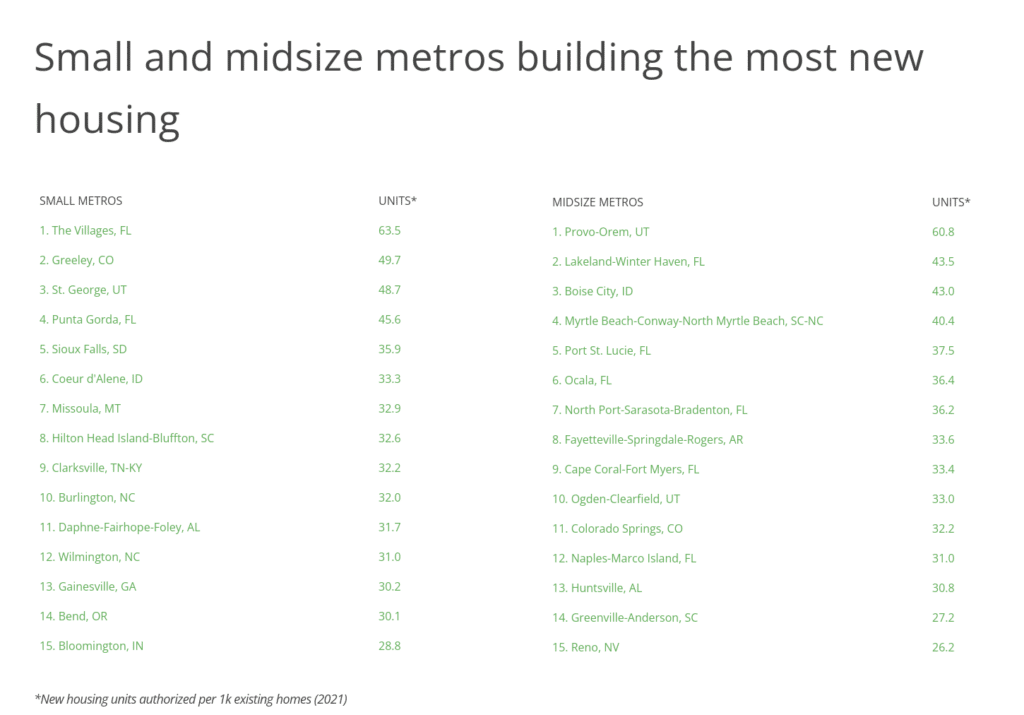

Although supply is a challenge across the U.S., some locations are moving faster than others in authorizing new construction. Fast-growing states in the Mountain West, like Utah, Idaho, and Colorado, along with Sun Belt destinations like Texas and Florida, lead the U.S. in the rate of new housing authorizations relative to existing homes. At the local level, major cities in these fast-growing states are also among the leading metros for new home construction.

To determine the metros building the most homes, researchers at Inspection Support Network analyzed the latest data from the U.S. Census Bureau and Zillow. The researchers ranked metro areas according to the number of new housing units authorized per 1,000 existing homes in 2021. In the event of a tie, the metro with higher total new housing units authorized in 2021 was ranked higher.

Here are the U.S. metros building the most homes.

Large Metros Building the Most New Housing

Photo Credit: Checubus / Shutterstock

Photo Credit: Checubus / Shutterstock

15. Minneapolis-St. Paul-Bloomington, MN-WI

- New housing units authorized per 1k existing homes (2021): 17.9

- New housing units authorized per 1k existing homes (2019): 15.7

- Total new housing units authorized (2021): 26,077

- Total new housing units authorized (2019): 22,414

- Percentage change in housing units authorized (2019–2021): +16.3%

- Median home price: $374,074

Photo Credit: Sean Pavone / Shutterstock

Photo Credit: Sean Pavone / Shutterstock

14. Richmond, VA

- New housing units authorized per 1k existing homes (2021): 18.1

- New housing units authorized per 1k existing homes (2019): 16.1

- Total new housing units authorized (2021): 9,547

- Total new housing units authorized (2019): 8,340

- Percentage change in housing units authorized (2019–2021): +14.5%

- Median home price: $320,654

Photo Credit: Jeremy Janus / Shutterstock

Photo Credit: Jeremy Janus / Shutterstock

13. Seattle-Tacoma-Bellevue, WA

- New housing units authorized per 1k existing homes (2021): 19.0

- New housing units authorized per 1k existing homes (2019): 17.0

- Total new housing units authorized (2021): 30,743

- Total new housing units authorized (2019): 26,599

- Percentage change in housing units authorized (2019–2021): +15.6%

- Median home price: $791,933

Photo Credit: Sean Pavone / Shutterstock

Photo Credit: Sean Pavone / Shutterstock

12. San Antonio-New Braunfels, TX

- New housing units authorized per 1k existing homes (2021): 24.6

- New housing units authorized per 1k existing homes (2019): 18.0

- Total new housing units authorized (2021): 22,264

- Total new housing units authorized (2019): 15,895

- Percentage change in housing units authorized (2019–2021): +40.1%

- Median home price: $329,532

Photo Credit: Andrew Zarivny / Shutterstock

Photo Credit: Andrew Zarivny / Shutterstock

11. Denver-Aurora-Lakewood, CO

- New housing units authorized per 1k existing homes (2021): 25.9

- New housing units authorized per 1k existing homes (2019): 16.7

- Total new housing units authorized (2021): 30,006

- Total new housing units authorized (2019): 19,308

- Percentage change in housing units authorized (2019–2021): +55.4%

- Median home price: $639,316

Photo Credit: Gregory E. Clifford / Shutterstock

Photo Credit: Gregory E. Clifford / Shutterstock

10. Phoenix-Mesa-Chandler, AZ

- New housing units authorized per 1k existing homes (2021): 26.0

- New housing units authorized per 1k existing homes (2019): 19.0

- Total new housing units authorized (2021): 50,581

- Total new housing units authorized (2019): 35,873

- Percentage change in housing units authorized (2019–2021): +41.0%

- Median home price: $466,170

Buying or selling? Home inspections are a crucial part of the process for everyone. ISN the process things faster and easier for inspectors and their clients.

Photo Credit: Sean Pavone / Shutterstock

Photo Credit: Sean Pavone / Shutterstock

9. Houston-The Woodlands-Sugar Land, TX

- New housing units authorized per 1k existing homes (2021): 26.2

- New housing units authorized per 1k existing homes (2019): 25.0

- Total new housing units authorized (2021): 69,263

- Total new housing units authorized (2019): 63,672

- Percentage change in housing units authorized (2019–2021): +8.8%

- Median home price: $299,998

Photo Credit: photo.ua / Shutterstock

Photo Credit: photo.ua / Shutterstock

8. Salt Lake City, UT

- New housing units authorized per 1k existing homes (2021): 27.3

- New housing units authorized per 1k existing homes (2019): 25.9

- Total new housing units authorized (2021): 11,642

- Total new housing units authorized (2019): 10,680

- Percentage change in housing units authorized (2019–2021): +9.0%

- Median home price: $602,765

Photo Credit: Sean Pavone / Shutterstock

Photo Credit: Sean Pavone / Shutterstock

7. Dallas-Fort Worth-Arlington, TX

- New housing units authorized per 1k existing homes (2021): 27.9

- New housing units authorized per 1k existing homes (2019): 23.1

- Total new housing units authorized (2021): 78,705

- Total new housing units authorized (2019): 62,708

- Percentage change in housing units authorized (2019–2021): +25.5%

- Median home price: $381,089

Photo Credit: digidreamgrafix / Shutterstock

Photo Credit: digidreamgrafix / Shutterstock

6. Charlotte-Concord-Gastonia, NC-SC

- New housing units authorized per 1k existing homes (2021): 28.4

- New housing units authorized per 1k existing homes (2019): 24.1

- Total new housing units authorized (2021): 30,126

- Total new housing units authorized (2019): 24,637

- Percentage change in housing units authorized (2019–2021): +22.3%

- Median home price: $372,300

Photo Credit: Songquan Deng / Shutterstock

Photo Credit: Songquan Deng / Shutterstock

5. Orlando-Kissimmee-Sanford, FL

- New housing units authorized per 1k existing homes (2021): 29.0

- New housing units authorized per 1k existing homes (2019): 24.2

- Total new housing units authorized (2021): 30,618

- Total new housing units authorized (2019): 24,470

- Percentage change in housing units authorized (2019–2021): +25.1%

- Median home price: $376,474

Photo Credit: GagliardiPhotography / Shutterstock

Photo Credit: GagliardiPhotography / Shutterstock

4. Jacksonville, FL

- New housing units authorized per 1k existing homes (2021): 34.6

- New housing units authorized per 1k existing homes (2019): 23.1

- Total new housing units authorized (2021): 22,738

- Total new housing units authorized (2019): 14,687

- Percentage change in housing units authorized (2019–2021): +54.8%

- Median home price: $355,286

Photo Credit: Sean Pavone / Shutterstock

Photo Credit: Sean Pavone / Shutterstock

3. Raleigh-Cary, NC

- New housing units authorized per 1k existing homes (2021): 39.5

- New housing units authorized per 1k existing homes (2019): 25.5

- Total new housing units authorized (2021): 21,649

- Total new housing units authorized (2019): 13,320

- Percentage change in housing units authorized (2019–2021): +62.5%

- Median home price: $445,219

Photo Credit: Sean Pavone / Shutterstock

Photo Credit: Sean Pavone / Shutterstock

2. Nashville-Davidson–Murfreesboro–Franklin, TN

- New housing units authorized per 1k existing homes (2021): 40.8

- New housing units authorized per 1k existing homes (2019): 30.1

- Total new housing units authorized (2021): 32,191

- Total new housing units authorized (2019): 22,702

- Percentage change in housing units authorized (2019–2021): +41.8%

- Median home price: $433,158

Photo Credit: Sean Pavone / Shutterstock

Photo Credit: Sean Pavone / Shutterstock

1. Austin-Round Rock-Georgetown, TX

- New housing units authorized per 1k existing homes (2021): 59.4

- New housing units authorized per 1k existing homes (2019): 39.7

- Total new housing units authorized (2021): 50,907

- Total new housing units authorized (2019): 32,037

- Percentage change in housing units authorized (2019–2021): +58.9%

- Median home price: $594,441

Detailed Findings & Methodology

To determine the metros building the most homes, researchers at Inspection Support Network analyzed the latest data from the U.S. Census Bureau’s Building Permit Survey and Zillow’s Zillow Home Value Index (ZHVI). The researchers ranked metro areas according to the number of new housing units authorized per 1,000 existing homes in 2021. In the event of a tie, the metro with higher total new housing units authorized in 2021 was ranked higher. Researchers also calculated the number of new housing units authorized per 1,000 existing homes in 2019, the total new housing units authorized in 2019, the percentage change in housing units authorized from 2019 to 2021, and the current median home price.

Only metropolitan areas with available data and with at least 100,000 people were included in the analysis. Additionally, metro areas were grouped into the following cohorts based on population size:

- Small metros: 100,000–349,999

- Midsize metros: 350,000–999,999

- Large metros: 1,000,000 or more