The housing market is showing some movement – and it’s worth paying attention if you’re in the inspection business.

Inventory is finally climbing, giving buyers a few more options than they’ve had in recent years. Sales picked up in May compared to April, even though they’re still tracking behind last year. And while mortgage rates aren’t exactly low, forecasters expect them to ease slightly by the end of the year.

Here’s what we’re seeing in the latest data:

Existing home sales and inventory – a look back at May

- May 2025 existing home sales hit 389,000 (non-seasonally adjusted), up +11.5% from April but down -4% year-over-year

- Year-to-date sales are still down -2.8% compared to last year

- Inventory rose to 1.54 million homes, a +6.2% jump from April and the highest it’s been since 2020

- Months of supply climbed to 4.6 months, showing the market is balancing out—but still tight

- HouseCanary reports a +22.9% increase in inventory year-over-year and a +5.8% rise in contract volume

- Closed home prices rose +1.9%, but sellers made +34.7% more price cuts to meet buyers where they are

Home prices and regional trends

- The national median existing home price hit $422,800, a +1.3% gain year-over-year

- Price gains were biggest in the Midwest (+3.4%) and Northeast (+7.1%)

Mortgage rate update

- Mortgage rates averaged 6.8% in June 2025, still elevated but holding steady

- Projections suggest rates could dip to around 6.5% by year-end, helping more buyers jump back in

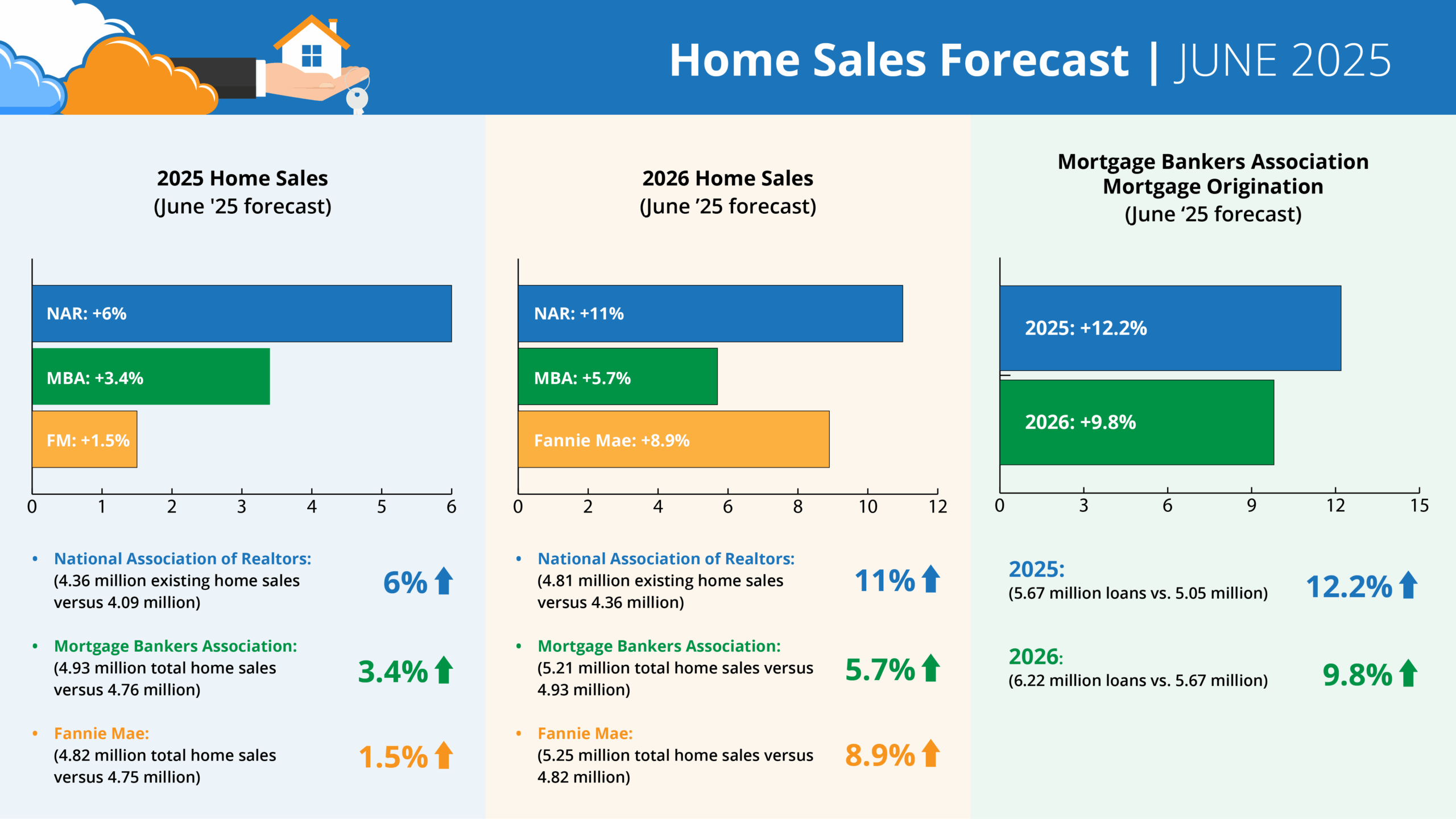

2025 home sales forecasts (June 2025)

- NAR: +6% growth to 4.36 million existing home sales (up from 4.09 million in 2024)

- MBA: +3.4% growth to 4.93 million total home sales (up from 4.76 million)

- Fannie Mae: +1.5% growth to 4.82 million total home sales (up from 4.75 million)

2026 home sales forecasts (June 2025)

- NAR: +11% growth to 4.81 million existing home sales (up from 4.36 million)

- MBA: +5.7% growth to 5.21 million total home sales (up from 4.93 million)

- Fannie Mae: +8.9% growth to 5.25 million total home sales (up from 4.82 million)

MBA mortgage originations forecast (June 2025):

2025 total mortgage originations: +12.2% growth to 5.67 million loans (up from 5.05 million)

- Purchase: +2.4% growth to 3.44 million loans (up from 3.36 million)

- Refinance: +31.8% growth to 2.23 million loans (up from 1.69 million)

2026 total mortgage originations: +9.8% growth to 6.22 million loans (up from 5.67 million)

-

- Purchase: +5.9% growth to 3.64 million loans (up from 3.44 million)

- Refinance: +15.8% growth to 2.58 million loans (up from 2.23 million)

What this means for inspectors

Inventory growth is giving buyers more choices, but pricing and rates are still a sticking point. If mortgage rates dip later this year, we could see a stronger fall season. Now’s the time to stay connected with your agents, keep your online scheduler up to date, and be ready for an increase in last-minute inspection requests.