The latest housing numbers are in, and while June didn’t bring major changes, there are a few big things worth watching. Sales were slightly up, prices are creeping higher in some areas, and forecasts for 2025 are trending lower than expected.

That said, inventory’s still strong, and 2026 is shaping up to be a solid year. If mortgage rates ease up (and experts think they will), we could see fall activity pick up. That’s good news for inspectors heading into the back half of the year.

Existing home sales and inventory – a look at June 2025

- Existing home sales for June 2025 totaled 391,000 (non-seasonally adjusted), essentially flat from May (+0.3% MoM) and up +4.0% YoY; year-to-date existing home sales are down -1.5%

- Inventory held at 1.53 million homes, just below the May peak and up +15.9% YoY

- HouseCanary reports a +23.1% YoY increase in inventory and a +7.3% increase in contract volume; closed prices rose +2.8%, while price cuts increased +32.3%

- The national median existing home price increased to $435,300, a +2.0% YoY gain, with the Midwest (+3.4%) and Northeast (+4.2%) leading price growth

- Mortgage rates averaged 6.8% in June, with expectations for a slight decline to around 6.7% by year-end, according to the Mortgage Bankers Association (MBA)

NAR existing home sales forecast

NAR released their second quarter forecast update this month:

- The outlook for existing home sales in 2025 was lowered to 3% YoY growth (from 6%)

- The 2026 existing home sales forecast increased to +14% YoY growth (from 11%)

- The 2025 existing home sales forecast average (including NAR, MBA and Fannie Mae) is now +2.3% YoY growth, down from 6.8% at the beginning of the year

Current forecasts

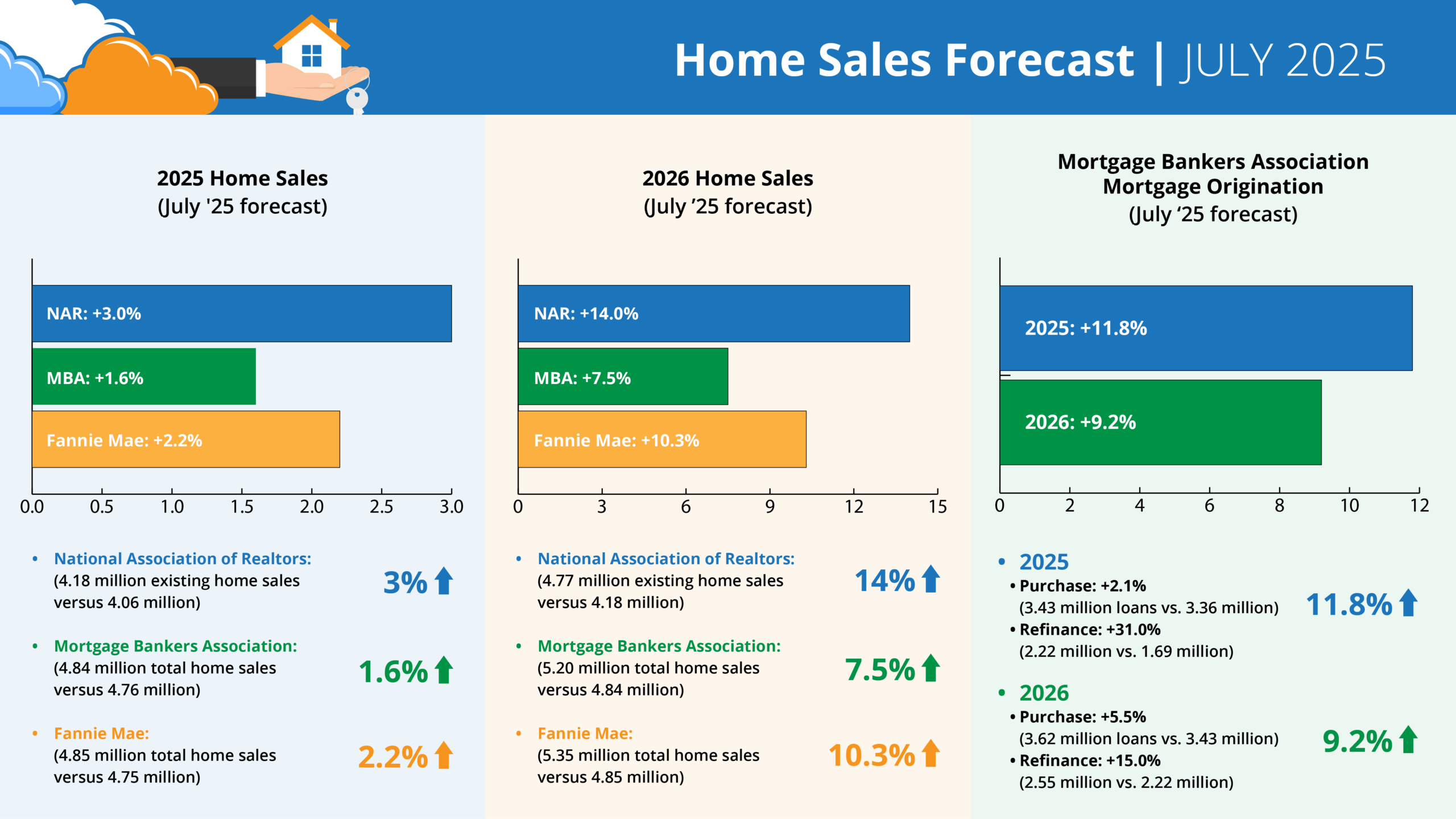

Forecasts for 2025 home sales (July ’25 forecast)

- NAR: +3.0% (4.18 million existing home sales vs. 4.06 million)

- MBA: +1.6% (4.84 million total home sales vs. 4.76 million)

- Fannie Mae: +2.2% (4.85 million total home sales vs. 4.75 million)

Forecasts for 2026 home sales (July ’25 forecast)

- NAR: +14.0% (4.77 million existing home sales vs. 4.18 million)

- MBA: +7.5% (5.20 million total home sales vs. 4.84 million)

- Fannie Mae: +10.3% (5.35 million total home sales vs. 4.85 million)

MBA forecast for mortgage originations (July ’25 forecast)

2025 total mortgage originations: +11.8% (5.65 million loans vs. 5.05 million)

- Purchase: +2.1% (3.43 million loans vs. 3.36 million)

- Refinance: +31.0% (2.22 million vs. 1.69 million)

2026 total mortgage originations: +9.2% (6.17 million loans vs. 5.65 million)

- Purchase: +5.5% (3.62 million loans vs. 3.43 million)

- Refinance: +15.0% (2.55 million vs. 2.22 million)

What this means for inspectors

The market isn’t booming, but it’s not backing down either. With steady inventory and moderate price growth, inspections are still happening, especially in areas where affordability is improving.

If you’re using ISN to stay visible with agents, reduce reschedules, and keep last-minute bookings organized, you’re in a strong spot. Now’s the time to lean into tools that give you a scheduling and communication edge – and help you spend less time chasing paperwork.