December closed out 2025 with a small but noticeable lift in activity, and 2026 forecasts are pointing toward moderate growth.

Existing home sales for December 2025 totaled 345,000 (non-seasonally adjusted), up +16.9% from November and +4.9% YoY, according to the National Association of Realtors (NAR). Even with that bump, total 2025 sales finished essentially flat at 4,061,000 compared to 4,062,000 in 2024.

Inventory remains tight. Total housing inventory at the end of December was 1.18 million units, down -18.1% from November, but +3.5% higher than a year ago, according to Zillow. Month to month, supply pulled back. Year over year, it slightly improved.

Pricing is steady overall, with some regional variation. NAR reported a +0.4% YoY increase in December to $405,400 nationally. The Northeast and Midwest saw price growth above +3%, while the West contracted -1.4%.

MBA reported the national median existing home price at $409,200, up +1.2% YoY. The Midwest led at +5.8%, followed by the Northeast at +1.1%, the South at +0.8%, and the West at -0.9%.

Mortgage rates ended 2025 at 6.2%, according to the Mortgage Bankers Association (MBA) and Fannie Mae. Fannie projects rates easing to 6.0% by mid-2026 and holding there through 2027. MBA expects the 30-year fixed rate to stay between 6.1% and 6.3% through 2027.

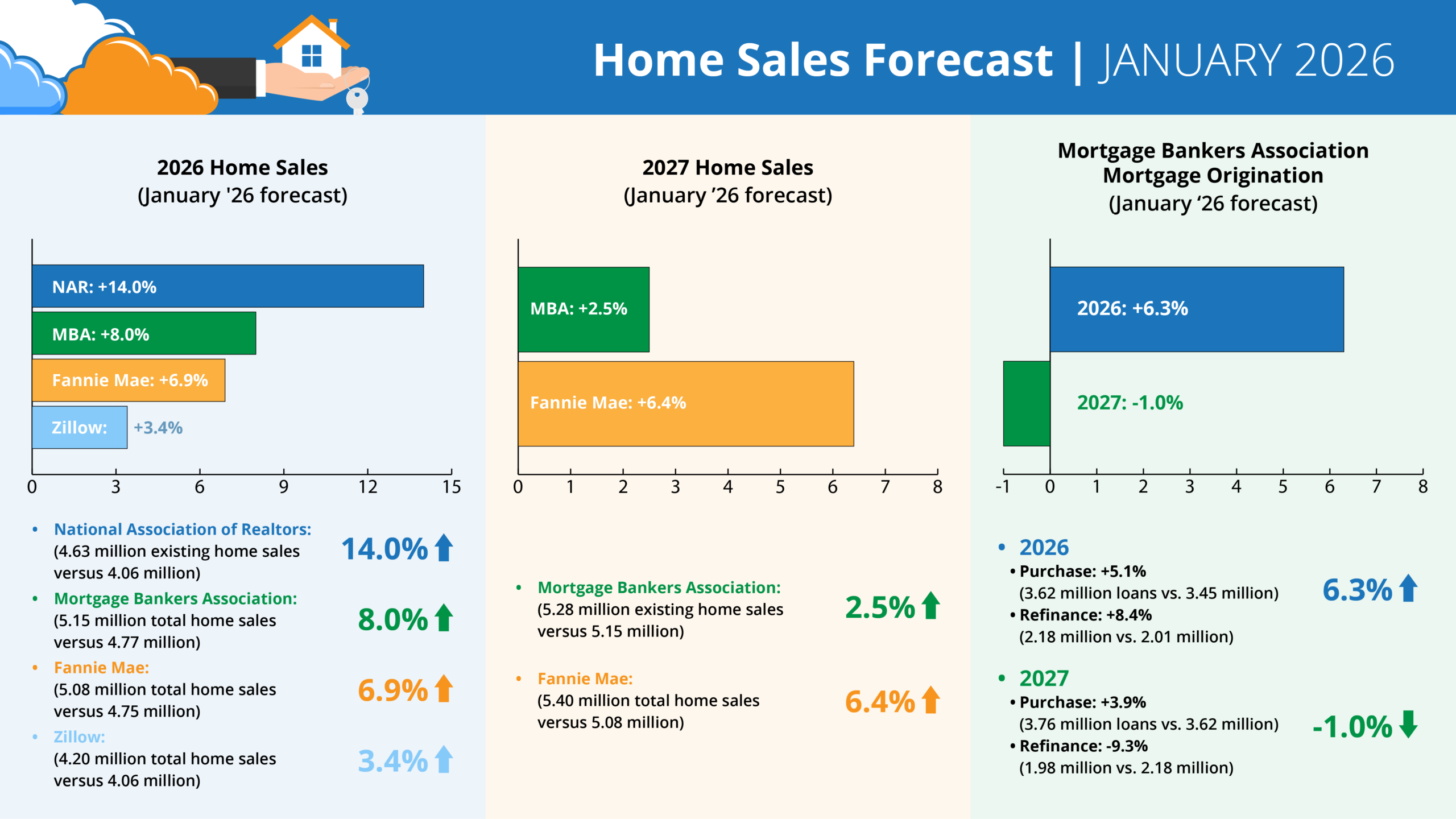

What forecasts say about 2026

January 2026 projections show expected sales growth next year:

- NAR: +14.0% (4.63 million existing home sales vs. 4.06 million)

- MBA: +8.0% (5.15 million total home sales vs. 4.77 million)

- Fannie Mae: +6.9% (5.08 million total home sales vs. 4.75 million)

- Zillow: +3.4% (4.20 million existing home sales vs. 4.06 million)

For 2027:

- MBA: +2.5% (5.28 million vs. 5.15 million)

- Fannie Mae: +6.4% (5.40 million vs. 5.08 million)

Mortgage originations

MBA’s January forecast projects:

2026 total mortgage originations: +6.3% (5.80 million loans vs. 5.46 million)

- Purchase: +5.1% (3.62 million vs. 3.45 million)

- Refi: +8.4% (2.18 million vs. 2.01 million)

2027 total mortgage originations: -1.0% (5.74 million vs. 5.80 million)

- Purchase: +3.9% (3.76 million vs. 3.62 million)

- Refi: -9.3% (1.98 million vs. 2.18 million)

Bottom line for multi-inspector teams: forecasts suggest more transactions in 2026 than 2025, but not a surge. Gradual growth means systems, scheduling, staffing, and report turn times matter. If volume increases by even mid-single digits, the teams with tight systems may just win the extra volume.