The housing outlook may be showing signs of contraction.

In August, Fannie Mae called for a slight dip in 2025 sales (-0.1%). In addition, the average forecast has slipped from +11.8% growth in January 2024 to just +1.4% growth in August.

For inspectors, that shift means keeping an eye on how slowing sales and shifting demand shape opportunities in the months ahead.

August highlights for July data

- Existing home sales for July 2025 totaled 388,000 (non-seasonally adjusted), -0.8% from June and -0.5% YoY. Year-to-date existing home sales are -1.3%.

- Inventory rose to 1.55 million homes from 1.53 million and +15.7% year-over-year.

- HouseCanary reports a +7.7% increase in contract volume. Closed prices increased +3.4% while price cuts increased +25.7%.

- The national median existing home price increased to $422,400, a +0.2% YoY gain, with the Midwest (+3.9%) and West (-1.4%) as the largest changes.

- Mortgage rates averaged 6.8% in June, with expectations for a slight decline to around 6.6% by year-end, according to the Mortgage Bankers Association (MBA).

Current forecasts

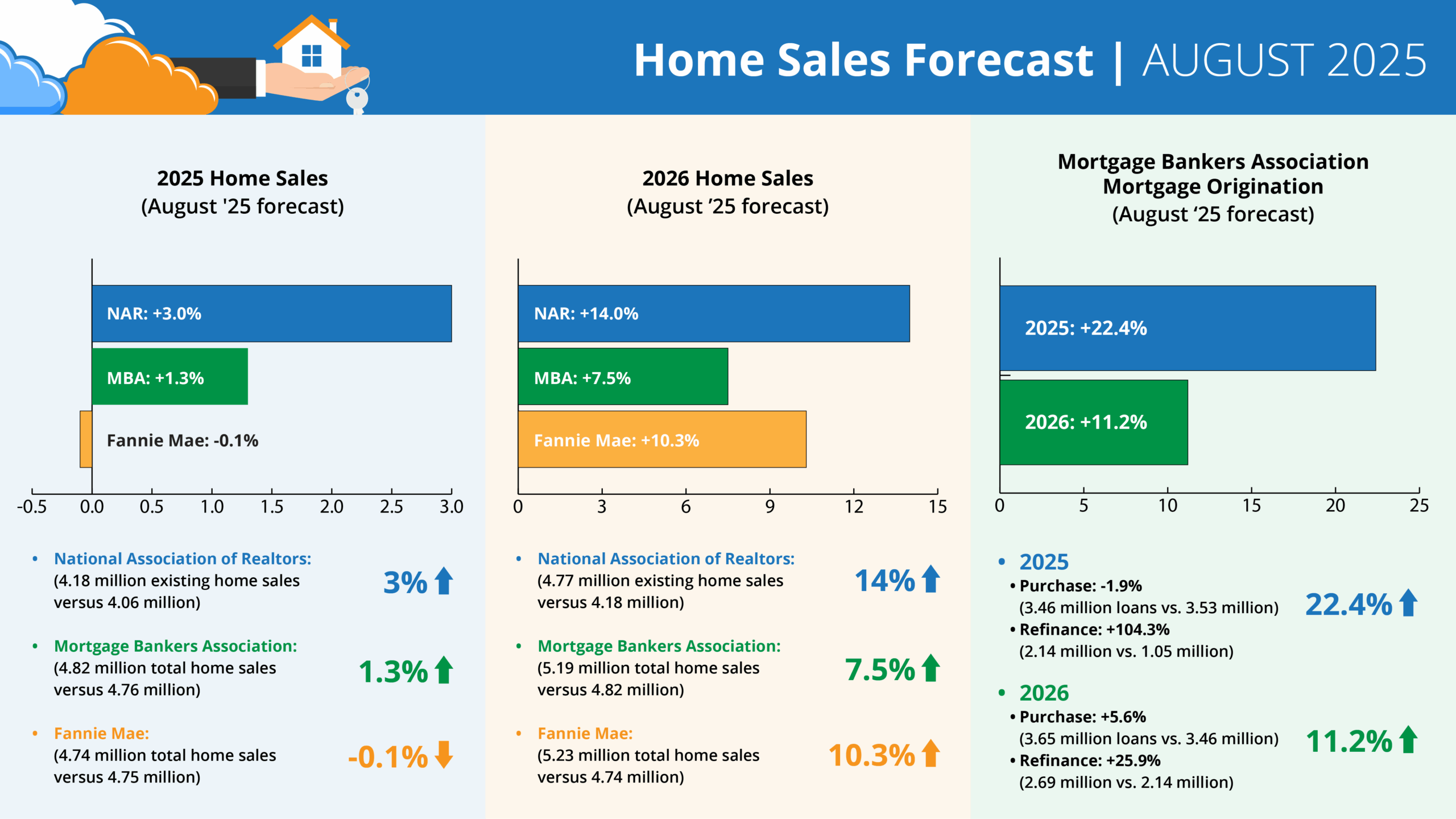

Forecasts for 2025 home sales (August ’25 forecast)

- NAR: +3% (4.18 million existing home sales vs. 4.06 million)

- MBA: +1.3% (4.82 million total home sales vs. 4.76 million)

- Fannie: -0.1% (4.74 million total home sales vs. 4.75 million)

Forecasts for 2026 home sales (August ’25 forecast)

- NAR: +14% (4.77 million existing home sales vs. 4.18 million)

- MBA: +7.5% (5.19 million total home sales vs. 4.82 million)

- Fannie: +10.3% (5.23 million total home sales vs. 4.74 million)

MBA forecast for mortgage originations (August ’25 forecast)

- 2025 Total Mortgage Originations: +22.4% (5.6 million loans vs. 4.57 million)

- Purchase: -1.9% (3.46 million loans vs. 3.53 million)

- Refi: +104.3% (2.14 million vs. 1.05 million)

- 2026 Total Mortgage Originations: +11.2% (6.22 million loans vs. 5.6 million)

- Purchase: +5.6% (3.65 million loans vs. 3.46 million)

- Refi: +25.9% (2.69 million vs. 2.14 million)

What it means for inspectors

For inspection businesses, the story is less about shrinking sales and more about what’s happening underneath: more homes hitting the market (+15.7% inventory), more sellers adjusting (price cuts +25.7%), and buyers still moving – just cautiously. That mix means plenty of opportunity, especially if you’ve got tools to keep your business efficient and responsive when the market starts shifting gears.